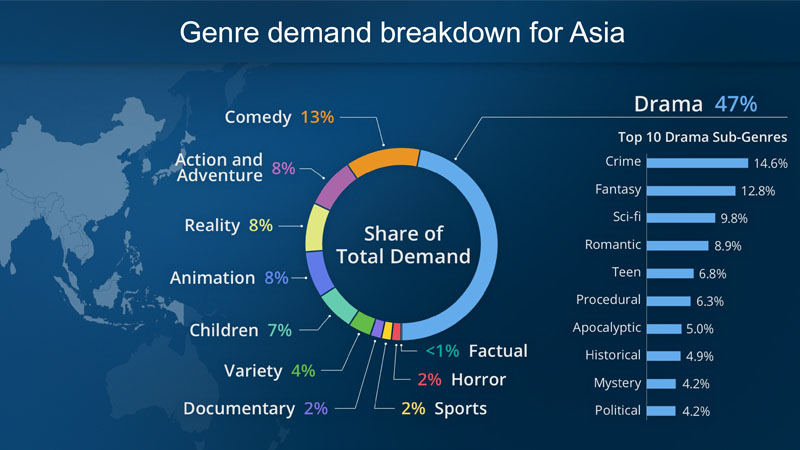

Drama, followed a distant second by comedy, is Asia’s most-favoured story telling genre in the first half of this year, according to Parrot Analytics’ data compiled for the ContentAsia Summit in September.

Asia loves a good crime drama, clearly, although there’s no shortage of affinity in the region for fantasy either, as Parrot Analytics’ demand expressions data for the first half of this year shows. Even if Asia falls a bit behind global averages in its demand for drama, the genre still commands a 47% of all video demand.

Asia exceeds global averages in action/adventure, reality, variety and shorts, with the most significant surge over anywhere else in the world happening in the children’s content space.

Between them, the region’s top two genres – drama and comedy – take a 60% share of demand. Action/adventure, reality and animation tie for third place at 8% share each, leaving the rest – including documentary and factual – jostling for the remaining 16%.

Two Korean dramas – Suspicious Partner and Fight For My Way – made the top 15 regional list for the first half of this year. Another two Asian titles – Running Man and Naruto Shippuden – also made the list, which was topped by The Walking Dead, Game of Thrones and The Flash.

In Korea, Korean drama, unsurprisingly, sweeps demand, with HBO’s Game of Thrones coming in at less than a third of the demand for top Korean title Fight for My Way. Korean drama took 90% of demand share in Korea in July, with the remaining 10% split between U.S. drama (8%) and U.K. drama (2%).

As it is with demand for blockbuster U.S. titles, not all taste for Korean drama across the region is equal, particularly not in Korea. Suspicious Partner, for instance, was significantly more popular in Hong Kong, China, Vietnam and Taiwan than it was in Korea.

This is, of course, not a generic rule, and differs show by show, Stefan Nordbruch, Parrot Analytics’ customer success manager, told ContentAsia Summit delegates. Band of Sisters, for instance, is far more popular in Korea than anywhere else in Asia. Variety show Infinite Challenge, too, is way more popular in Korea than it is anywhere else.

Nordbruch also showed a comparison of demand for Korean drama Descendants of the Sun and Game of Thrones from 1 May to 20 August, saying that activity beyond the main screen – from the release of trailers to live social media sessions with stars – was a powerful demand driver.

This article was originally publ...

Drama, followed a distant second by comedy, is Asia’s most-favoured story telling genre in the first half of this year, according to Parrot Analytics’ data compiled for the ContentAsia Summit in September.

Asia loves a good crime drama, clearly, although there’s no shortage of affinity in the region for fantasy either, as Parrot Analytics’ demand expressions data for the first half of this year shows. Even if Asia falls a bit behind global averages in its demand for drama, the genre still commands a 47% of all video demand.

Asia exceeds global averages in action/adventure, reality, variety and shorts, with the most significant surge over anywhere else in the world happening in the children’s content space.

Between them, the region’s top two genres – drama and comedy – take a 60% share of demand. Action/adventure, reality and animation tie for third place at 8% share each, leaving the rest – including documentary and factual – jostling for the remaining 16%.

Two Korean dramas – Suspicious Partner and Fight For My Way – made the top 15 regional list for the first half of this year. Another two Asian titles – Running Man and Naruto Shippuden – also made the list, which was topped by The Walking Dead, Game of Thrones and The Flash.

In Korea, Korean drama, unsurprisingly, sweeps demand, with HBO’s Game of Thrones coming in at less than a third of the demand for top Korean title Fight for My Way. Korean drama took 90% of demand share in Korea in July, with the remaining 10% split between U.S. drama (8%) and U.K. drama (2%).

As it is with demand for blockbuster U.S. titles, not all taste for Korean drama across the region is equal, particularly not in Korea. Suspicious Partner, for instance, was significantly more popular in Hong Kong, China, Vietnam and Taiwan than it was in Korea.

This is, of course, not a generic rule, and differs show by show, Stefan Nordbruch, Parrot Analytics’ customer success manager, told ContentAsia Summit delegates. Band of Sisters, for instance, is far more popular in Korea than anywhere else in Asia. Variety show Infinite Challenge, too, is way more popular in Korea than it is anywhere else.

Nordbruch also showed a comparison of demand for Korean drama Descendants of the Sun and Game of Thrones from 1 May to 20 August, saying that activity beyond the main screen – from the release of trailers to live social media sessions with stars – was a powerful demand driver.

This article was originally published in the October 2017 print issue for MIPCOM 2017 in Cannes