YouTube Premium’s Japanese reality show, Fishers and the Lost Treasure, pushed aside every other digital original in Japan during Q2 2021. This despite reality as a genre attracting a small fraction of the demand for drama and animation. The next made-in-Japan original on the top 20 list of shows most in demand for the quarter was Netflix’s The Naked Director, which generated half the demand of Fishers, according to data science company Parrot Analytics’ “Global Television Demand Report for Q2 2021”. The other two shows on the top three for April, May and June were Disney+’s The Falcon and the Winter Soldier and WandaVision.

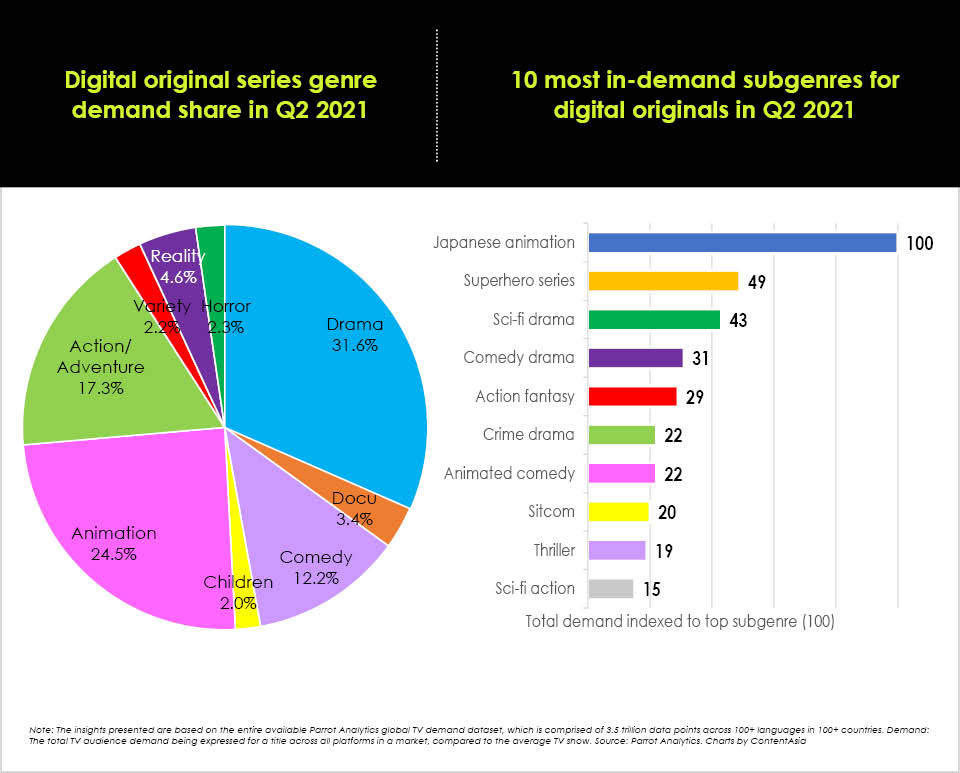

Digital original series genre demand share in Q2 2021:

Japan is exceptional in that its share of demand for animated original content is significantly higher than other markets. Its 24.5% share of demand for this genre is 4x more as large as the global share of demand (6%). The children (2%) and drama (31.6%) genres make up a smaller demand share for digital originals in Japan than any other market in this report.

10 most in-demand subgenres for digital originals in Q2 2021:

Anime is by far the most in-demand digital original subgenre with more than twice the demand of the next most in-demand subgenre – superhero series. While the popularity of anime helps explain the success of animation more generally in Japan, the fact that animated comedy also ranks more highly here than in any other market in this report indicates that Japanese audiences love animation beyond just the anime subgenre.

Demand share by platform for drama digital originals in Q2 2021:

Amazon Prime Video’s dramas have had notable success in Japan. The platform’s original dramas accounted for 15.5% of demand for all digital original dramas in Q2 2021. This is the largest share the platform achieved in this category in this report.

The share of demand for original dramas from Hulu (9.0%) in Japan is the global share of demand for this platform’s dramas - 5.7%. It is worth mentioning that Japan is the only non-U.S. market with a Hulu branded platform.

Just over the course of t...

YouTube Premium’s Japanese reality show, Fishers and the Lost Treasure, pushed aside every other digital original in Japan during Q2 2021. This despite reality as a genre attracting a small fraction of the demand for drama and animation. The next made-in-Japan original on the top 20 list of shows most in demand for the quarter was Netflix’s The Naked Director, which generated half the demand of Fishers, according to data science company Parrot Analytics’ “Global Television Demand Report for Q2 2021”. The other two shows on the top three for April, May and June were Disney+’s The Falcon and the Winter Soldier and WandaVision.

Digital original series genre demand share in Q2 2021:

Japan is exceptional in that its share of demand for animated original content is significantly higher than other markets. Its 24.5% share of demand for this genre is 4x more as large as the global share of demand (6%). The children (2%) and drama (31.6%) genres make up a smaller demand share for digital originals in Japan than any other market in this report.

10 most in-demand subgenres for digital originals in Q2 2021:

Anime is by far the most in-demand digital original subgenre with more than twice the demand of the next most in-demand subgenre – superhero series. While the popularity of anime helps explain the success of animation more generally in Japan, the fact that animated comedy also ranks more highly here than in any other market in this report indicates that Japanese audiences love animation beyond just the anime subgenre.

Demand share by platform for drama digital originals in Q2 2021:

Amazon Prime Video’s dramas have had notable success in Japan. The platform’s original dramas accounted for 15.5% of demand for all digital original dramas in Q2 2021. This is the largest share the platform achieved in this category in this report.

The share of demand for original dramas from Hulu (9.0%) in Japan is the global share of demand for this platform’s dramas - 5.7%. It is worth mentioning that Japan is the only non-U.S. market with a Hulu branded platform.

Just over the course of this quarter, HBO Max’s share of demand for original dramas has been cut in half, ending the quarter with a 1.4% demand share.

Note: The insights presented are based on the entire available Parrot Analytics global TV demand dataset, which is comprised of 3.5 trillion data points across 100+ languages in 100+ countries. Demand: The total TV audience demand being expressed for a title across all platforms in a market, compared to the average TV show. Source: Parrot Analytics. Charts by ContentAsia

Published in ContentAsia October 2021 Magazine