Global streamers command more than half the demand for series/originals in Asia Pacific, says data science company Parrot Analytics.

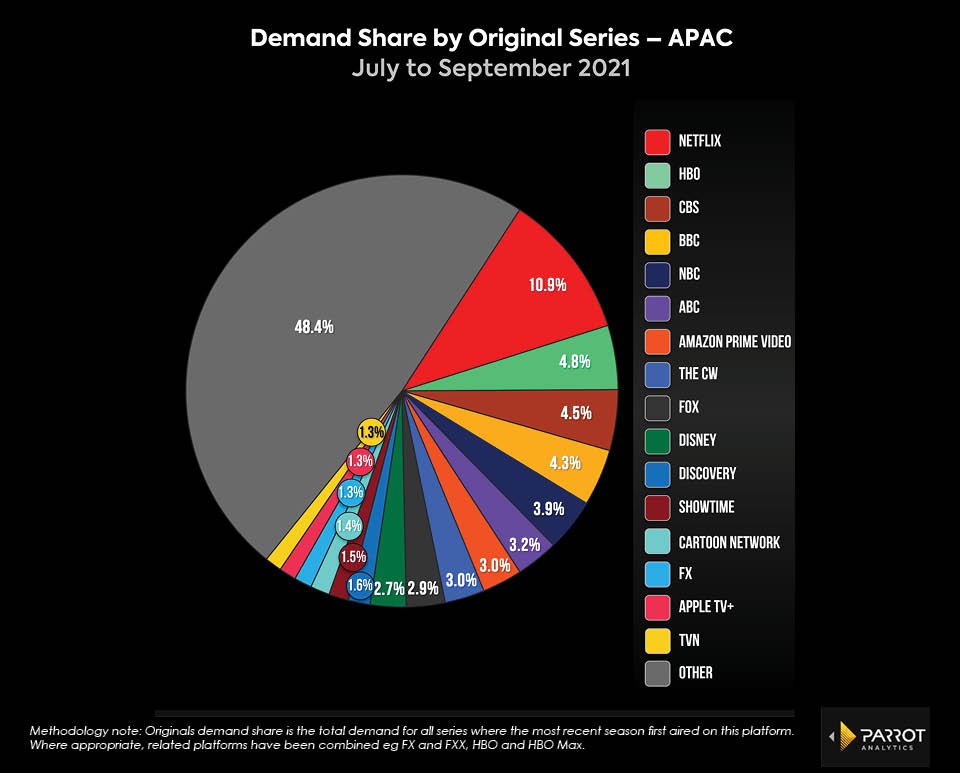

Just under half of audience demand for original series in the Asia-Pacific region in the three months to end September went to shows outside of major global networks/platforms, according to data science company Parrot Analytics.

Of today’s largest global programmers, Netflix, with 10.9% share, commanded more than double the demand of its closest rivals, led by HBO/HBO Max (4.8%), CBS (4.5% share), and BBC Studios (4.3%).

The latest figures show Netflix, Viacom and WarnerMedia neck and neck in share of demand for digital/streaming across Asia Pacific in the third quarter of this year, well behind Disney and at a fraction of the consolidated demand on a slew of domestic platforms.

Amazon Prime Video remains the second most in-demand streaming service for original content globally at 12.1% – boosted by the high global demand of its Indian originals.

Off the success of Ted Lasso, Apple TV+ is now the fourth most in-demand streaming service for original content globally, with 6.1% demand share in Q3 2021.

Apple TV+ leapfrogged Hulu (5.5%), but still trails Netflix (45.8%), Amazon Prime Video (12.1%) and Disney+ (8.4%).

In the U.S., Amazon Prime Video fell to third place for the first time, ending the quarter at 8.6%, behind Disney+’s 8.9%, driven by success of its live action Marvel series.

Parrot Analytics said that, collectively, the six largest media corporations controlled almost three quarters of U.S. demand for TV series. 29.2% of audience attention went to originals from other platforms in the quarter.

The highest share (20.1%) of U.S. audience attention in Q3 2021 was paid to series ultimately from the Walt Disney Company – including Hulu, Disney+ and Hotstar – with ViacomCBS content holding the second largest share (13.4%).

Also in its Q3 report, Parrot showed that Netflix’s share of global and U.S. demand for digital originals hit a record low, down to 45.8% globally and 43.7% in the U.S. In Q2 2021, Netflix was at 48.3% globally, and 46% in the U....

Global streamers command more than half the demand for series/originals in Asia Pacific, says data science company Parrot Analytics.

Just under half of audience demand for original series in the Asia-Pacific region in the three months to end September went to shows outside of major global networks/platforms, according to data science company Parrot Analytics.

Of today’s largest global programmers, Netflix, with 10.9% share, commanded more than double the demand of its closest rivals, led by HBO/HBO Max (4.8%), CBS (4.5% share), and BBC Studios (4.3%).

The latest figures show Netflix, Viacom and WarnerMedia neck and neck in share of demand for digital/streaming across Asia Pacific in the third quarter of this year, well behind Disney and at a fraction of the consolidated demand on a slew of domestic platforms.

Amazon Prime Video remains the second most in-demand streaming service for original content globally at 12.1% – boosted by the high global demand of its Indian originals.

Off the success of Ted Lasso, Apple TV+ is now the fourth most in-demand streaming service for original content globally, with 6.1% demand share in Q3 2021.

Apple TV+ leapfrogged Hulu (5.5%), but still trails Netflix (45.8%), Amazon Prime Video (12.1%) and Disney+ (8.4%).

In the U.S., Amazon Prime Video fell to third place for the first time, ending the quarter at 8.6%, behind Disney+’s 8.9%, driven by success of its live action Marvel series.

Parrot Analytics said that, collectively, the six largest media corporations controlled almost three quarters of U.S. demand for TV series. 29.2% of audience attention went to originals from other platforms in the quarter.

The highest share (20.1%) of U.S. audience attention in Q3 2021 was paid to series ultimately from the Walt Disney Company – including Hulu, Disney+ and Hotstar – with ViacomCBS content holding the second largest share (13.4%).

Also in its Q3 report, Parrot showed that Netflix’s share of global and U.S. demand for digital originals hit a record low, down to 45.8% globally and 43.7% in the U.S. In Q2 2021, Netflix was at 48.3% globally, and 46% in the U.S.

Parrot said total global demand for Netflix originals grew 3.3% in Q3 compared to Q2 2021, and was up 74% in the two years since Q2 2019.

“However, global demand for original content from Netflix’s competitors grew 14.3% in Q3 2021, and is up 196% since Q2 2019 – before competitors like Disney+, HBO Max, and Apple TV+ entered the market,” the report said, adding that “this matters because demand for original content is a key leading indicator of subscriber growth, so Netflix may be able to grow its subscriber base while its dominant position in the market continues to erode.”

Published in ContentAsia November 2021 Magazine