Local players in the Asia-Pacific region “may aggressively pivot towards NBCUniversal, Sony and Disney for deeper licensing partnerships” in the wake of Netflix’s Friday win, Media Partners Asia’s executive director, Vivek Couto, said this morning.

Issuing a note today headlined “The Ultimate Pivot: Netflix to Acquire WBD”, Couto adds that companies in the region may also “expand bundling opportunities with Disney+ to compete in a landscape where WBD and HBO Max move under Netflix”.

The deal creates a US$6.6-billion revenue powerhouse in the Asia Pacific – Netflix’s standalone ARR at US$5.5 billion and WBD contributing US$1.1 billion.

Couto says WBD’s current business in Asia relies on profitable licensing and theatrical businesses (US$1.1 billion, annual recurring revenue/ARR), with streaming still nascent outside of Australia. “While Netflix drives D2C growth, the WBD assets function as a regional arms dealer and theatrical powerhouse,” he adds.

Under the heading “The Licensing Cliff”, Couto says “WBD currently powers the SVOD value proposition of local leaders through exclusive licensing and strategic partnerships in India, Japan, Korea and other markets”.

“While these deals are secure through 2027, the merger creates major strategic choices. Post-close, Netflix may repatriate this content to bolster its own platforms, especially in major local markets.”

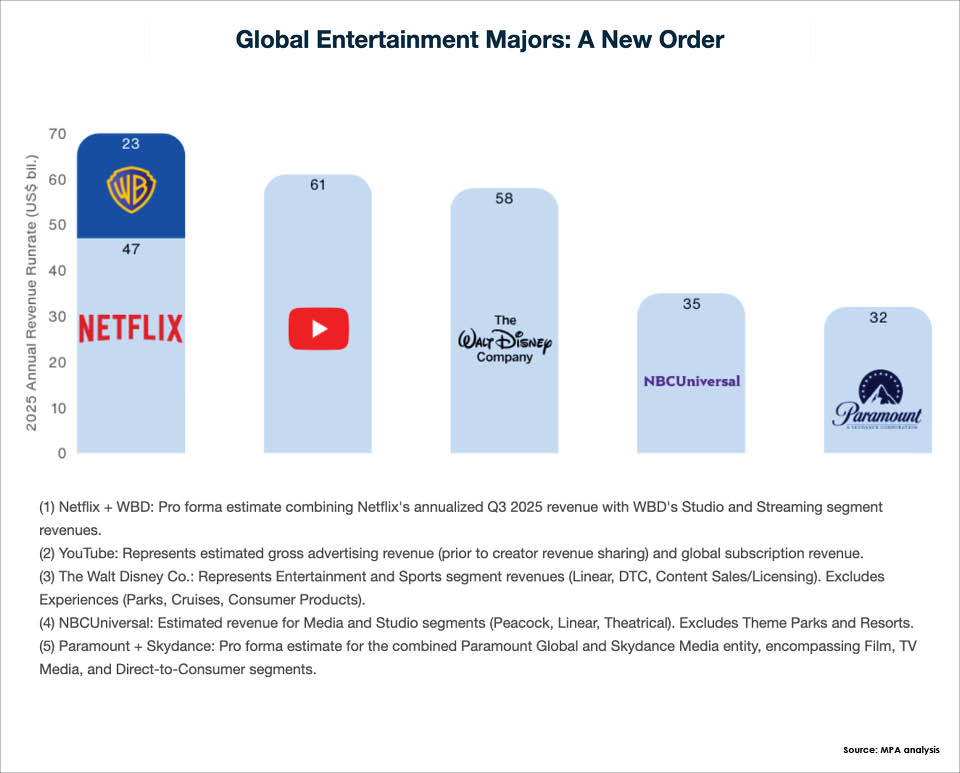

The combined Netflix-WBD entity creates a media and tech titan that tops the global entertainment hierarchy.

Netflix has agreed to a historic US$5.8 billion reverse termination fee if regulators block the deal, more than double the US$2.8 billion fee WBD will pay if it walks away for a superior offer.

“This signals Netflix’s high conviction and financial imperative to accept behavioral remedies to clear antitrust hurdles,” Couto says.

He points to Nielsen’s The Gauge (October 2025), which shows that the combined entity commands less than 10% of to...

Local players in the Asia-Pacific region “may aggressively pivot towards NBCUniversal, Sony and Disney for deeper licensing partnerships” in the wake of Netflix’s Friday win, Media Partners Asia’s executive director, Vivek Couto, said this morning.

Issuing a note today headlined “The Ultimate Pivot: Netflix to Acquire WBD”, Couto adds that companies in the region may also “expand bundling opportunities with Disney+ to compete in a landscape where WBD and HBO Max move under Netflix”.

The deal creates a US$6.6-billion revenue powerhouse in the Asia Pacific – Netflix’s standalone ARR at US$5.5 billion and WBD contributing US$1.1 billion.

Couto says WBD’s current business in Asia relies on profitable licensing and theatrical businesses (US$1.1 billion, annual recurring revenue/ARR), with streaming still nascent outside of Australia. “While Netflix drives D2C growth, the WBD assets function as a regional arms dealer and theatrical powerhouse,” he adds.

Under the heading “The Licensing Cliff”, Couto says “WBD currently powers the SVOD value proposition of local leaders through exclusive licensing and strategic partnerships in India, Japan, Korea and other markets”.

“While these deals are secure through 2027, the merger creates major strategic choices. Post-close, Netflix may repatriate this content to bolster its own platforms, especially in major local markets.”

The combined Netflix-WBD entity creates a media and tech titan that tops the global entertainment hierarchy.

Netflix has agreed to a historic US$5.8 billion reverse termination fee if regulators block the deal, more than double the US$2.8 billion fee WBD will pay if it walks away for a superior offer.

“This signals Netflix’s high conviction and financial imperative to accept behavioral remedies to clear antitrust hurdles,” Couto says.

He points to Nielsen’s The Gauge (October 2025), which shows that the combined entity commands less than 10% of total big screen watch time in the U.S.