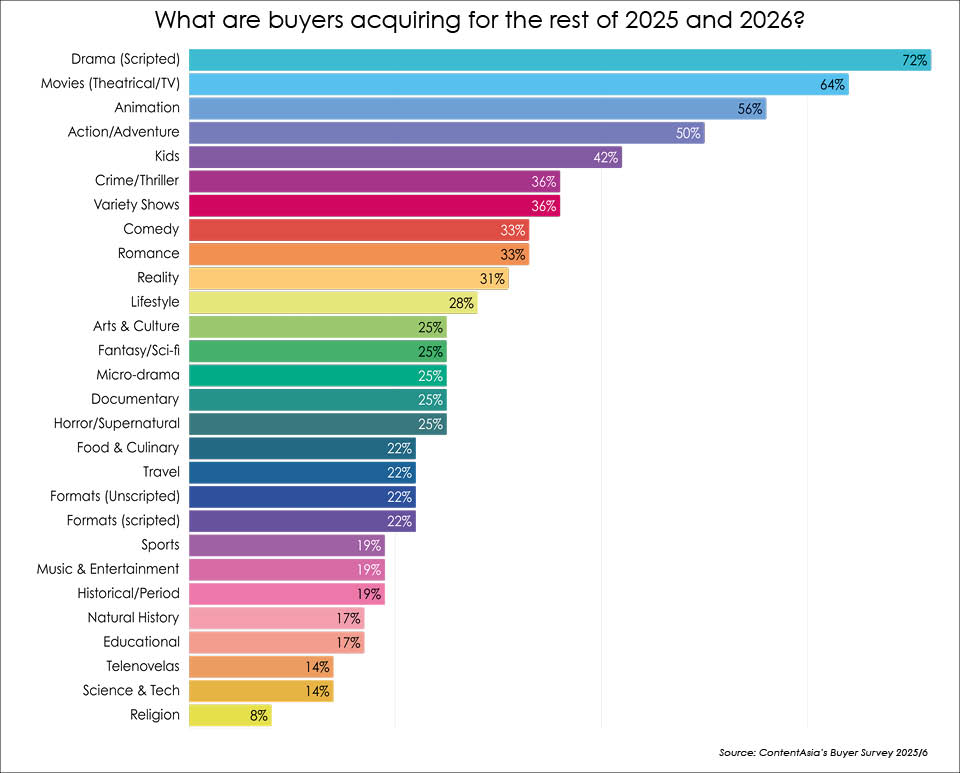

Scripted television series continue to lead acquisition priorities in Asia, with 72% of surveyed buyers identifying a genre broadly as a top strategic focus. Movies – including both theatrical and TV titles – follow at 64%, alongside animation at 56% and kids’ programming (42%). Drilling down into scripted, action/adventure led with 50% of buyers, followed by crime/thriller (36%). In the mid-tier, comedy (scripted and unscripted) and romance are each acquired by one in three buyers, with reality and lifestyle also holding steady.

Segments such as arts & culture, fantasy/sci-fi, documentary (general/investigative/biographical), and horror/supernatural attract one in four buyers, while food/culinary, sports, music/entertainment and historical titles capture smaller but steady interest.

Respondents highlight evolving strategic priorities as audience behaviours shift – though brand loyalty continues in some cases to outweigh short-term viewing spikes. In Japan, for example, the enduring success of long-running fan-favourite anime property, Detective Conan, ranks among this year’s strongest performers on one of the country’s major platforms.

KOREAN ORIGINALS Asian audiences’ sustained appetite for Korean content continues to drive acquisition strategies across the region. However, escalating licensing costs – reaching up to asks of US$900,000 per episode – driven by stratospheric production budgets are prompting buyers to reassess portfolio priorities. Platforms are increasingly diversifying with lower-cost acquisitions and alternative formats that deliver stronger cost-to-value efficiencies while sustaining competitive audience engagement.

Despite pricing pressures, selective investment continues to deliver results. In Taiwan, Bill Sung, EVP of Cai Chang International, highlights Korean fantasy epic Along with the Gods: The Two Worlds (Parts 1 & 2) as a standout performer, demonstrating the ongoing ability of premium Korean titles to drive significant viewership impact when carefully acquired, integrated into line-ups, and marketed.

SPORT Sport continues to dominate audience loyalty metrics. According to Kou Serey Ratha, content and acquisition manager at Bayon Media High System (Cambodia), local sports – particularly Kun Khmer and soccer – consistently rank among the network’s highest-rated programmes, underscoring their sustained ability to drive engagement. Zooming out (and despite steep drops in some markets), there seems to be nothing like a high-value international sports property to break open corporate purse-strings. ...

Scripted television series continue to lead acquisition priorities in Asia, with 72% of surveyed buyers identifying a genre broadly as a top strategic focus. Movies – including both theatrical and TV titles – follow at 64%, alongside animation at 56% and kids’ programming (42%). Drilling down into scripted, action/adventure led with 50% of buyers, followed by crime/thriller (36%). In the mid-tier, comedy (scripted and unscripted) and romance are each acquired by one in three buyers, with reality and lifestyle also holding steady.

Segments such as arts & culture, fantasy/sci-fi, documentary (general/investigative/biographical), and horror/supernatural attract one in four buyers, while food/culinary, sports, music/entertainment and historical titles capture smaller but steady interest.

Respondents highlight evolving strategic priorities as audience behaviours shift – though brand loyalty continues in some cases to outweigh short-term viewing spikes. In Japan, for example, the enduring success of long-running fan-favourite anime property, Detective Conan, ranks among this year’s strongest performers on one of the country’s major platforms.

KOREAN ORIGINALS Asian audiences’ sustained appetite for Korean content continues to drive acquisition strategies across the region. However, escalating licensing costs – reaching up to asks of US$900,000 per episode – driven by stratospheric production budgets are prompting buyers to reassess portfolio priorities. Platforms are increasingly diversifying with lower-cost acquisitions and alternative formats that deliver stronger cost-to-value efficiencies while sustaining competitive audience engagement.

Despite pricing pressures, selective investment continues to deliver results. In Taiwan, Bill Sung, EVP of Cai Chang International, highlights Korean fantasy epic Along with the Gods: The Two Worlds (Parts 1 & 2) as a standout performer, demonstrating the ongoing ability of premium Korean titles to drive significant viewership impact when carefully acquired, integrated into line-ups, and marketed.

SPORT Sport continues to dominate audience loyalty metrics. According to Kou Serey Ratha, content and acquisition manager at Bayon Media High System (Cambodia), local sports – particularly Kun Khmer and soccer – consistently rank among the network’s highest-rated programmes, underscoring their sustained ability to drive engagement. Zooming out (and despite steep drops in some markets), there seems to be nothing like a high-value international sports property to break open corporate purse-strings. In Indonesia, the latest three-year cycle of multi-platform Premier League rights are rumoured to have sold for US$60 million. In Thailand, domestic club football rights went to Jasmine International (JAS) and domestic telco Advanced Info Service (AIS) in a four-season deal worth a total THB 2 billion/US$54 million. That’s after JAS paid US$560 million/THB19.2 billion for six Premier League seasons from 2025/26 to 2030/31 for Thailand, Cambodia and Laos, including live broadcasts, reruns and highlights.

FAMILY DRAMA Family dramas are gaining prominence in acquisition strategies. According to Mariani Abdullah, head of acquisition and distribution at Brunei’s DM Don Square Entertainment, the strong focus on this genre reflects audience demand for stories that resonate with real-life experiences and everyday realities.

BOYS’ LOVE (BL) For buyers and platforms, the message is clear: niche genres are no longer peripheral. As competition intensifies, integrating Boys’ Love (BL) and other passion-driven formats into acquisition portfolios offers a path to audience diversification, brand differentiation, and incremental monetisation beyond traditional content verticals.

Thailand remains the regional leader in BL production, though some industry players caution that the segment may be approaching market saturation at home and has limited appeal in more conservative markets.

Even so, the success of Thai BL content highlights the growth potential of niche genres.

As Mediaplex International CEO Joe Suteestarpon observes, “Thai BL dramas have been standout performers for us this year,” underscoring both their domestic dominance and increasing international appeal.

RELIGION In Malaysia, Broken Heaven (Bidaah), a drama produced by Rumah Karya Citra, has emerged as a top-performing title. Centered on a young woman’s infiltration of a religious sect to save her devout mother, the series reflects audience engagement with religion-driven narratives and highlights the genre’s relevance in regional content strategies. Religious practices also underpin a rising slate of original family dramas.

KIDS By many accounts, the TV kids’ content sector is in serious decline, with production pipelines thinning and local output under pressure. Buyers are increasingly selective, placing the greatest emphasis on story quality, casting and market buzz as differentiators. With key exceptions, established international brands continue to dominate acquisition decisions, reinforcing the challenges faced by original and locally produced kids’ programming.

WHAT FACTORS MOST INFLUENCE YOUR DECISIONS? Asked about the factors that most influence acquisition decisions, respondents consistently cited budget and price points, underscoring the continued importance of cost-efficiency in content strategies.

Accurate assessment of market relevance and audience demand are also identified as critical acquisition drivers. Content must align with local viewer preferences, notes Artine S. Utomo, CEO of Indonesia’s free-TV network RTV, echoing a broader industry consensus.

Buyers – including Redian Tandiana, acquisition manager of ANTV Indonesia, and Taiwan’s Bill Sung of Cai Chang International Taiwan – emphasise flexibility in managing rights and strong marketing potential.

Gary Tsai, Taiwan’s Far EasTone Telecom COO, Digital Entertainment Service, and Gala Television’s manager Wenchia Shih, highlight the role of cast and star power. Ratings performance and localisation opportunities are emphasised by Shakuntala Chandra, APAC lead of Indian content creator, aggregator and distributor Shemaroo Entertainment, and Andri Detulong, head of acquisition of Jakarta-based distributor PT Satuvisi Abadi, which focuses on family-friendly programming for free-to-air and digital platforms in Indonesia.

In summary, while cost remains the primary filter, acquisition decisions are increasingly shaped by a balanced evaluation of audience alignment, rights flexibility, and proven market performance.

STREAMING’S IMPACT IS... The 2026 outlook shows streaming continuing to reshape acquisition and scheduling strategies. Fourteen respondents say they are prioritising exclusive or early release windows, while nine are leaning toward digital-first titles, and eight report shifting budgets from linear to digital. Although 13 buyers say their approach remains unchanged, the overall trend points to a steady tilt toward digital-driven acquisitions.

In scheduling, streaming’s influence is being felt across the board – whether or not companies operate their own OTT platforms.

Media Prima, which operates the country’s largest free-TV services (58% audience share in Jan-March 2025) along with digital platform Tonton, now treats OTT as a strategic pillar, with distinct planning from its free-to-air channels.

Shemaroo Entertainment’s Chandra pointed to streaming service ShemarooMe, which has grown into a multi-genre, multilingual offering. She notes that release schedules are now “closely aligned to when and how audiences choose to watch online”.

In Indonesia, ANTV’s Tandiana adds that audiences increasingly expect content in bingeable formats, a view echoed by Gary Tsai of Far EasTone, whose friDay Video platform integrates streaming with telecom data to refine programming strategies. Touch Bopha, director of Global PNN Holdings in Cambodia, says her team is also reshaping its approach, noting that OTT platforms have become an increasingly important space for testing new content and reaching younger viewers.

Not all feel the impact equally: DM Don Square Entertainment’s Abdullah says the OTT shift remains “not relevant” to current operations.

ORIGINAL CONTENT OUTLOOK Most content execs anticipate near-term stability in original production and spending. Close to 60% expect the same level of original content in 2026 as in 2025, while 17% say there will be increases and 14% foresee a decline.

Growth is expected from companies such as Bayon Media High System, ANTV and Mediaplex, while Cai Chang International and Thailand Kylo30 Project’s advisor/media specialist, Krissada Trishnananda, forecasts a scale back. Global PNN’s Bopha cites the challenges of sustaining original production in a highly competitive environment.

Most expect budgets to remain flat, with optimism at ANTV and Mediaplex, which plan to raise investments, and caution at Media Prima, which expects to reduce spending despite steady output. Far EasTone Telecom’s director Hanes Chin also points to a conservative stance, citing the need to balance production ambitions with market realities.

CHALLENGES AND OPPORTUNITIES Content execs flag challenges ranging from rising rights costs and the “battle for rights” to platform disruption.

Mediaplex International’s Suteestarpon describes the ongoing “shift from FTA (free-to-air) to OTT” as a defining change, while PT Satuvisi Abadi’s Detulong notes his team is “now into OTT” when making acquisitions.

Cai Chang International’s Bill Sung points to the broader economic climate, while RTV’s Utomo cites digital disruption and economic pressures as the biggest challenges.

“Indonesia’s biggest challenges are the digital content era and economic pressures. As viewing habits shift, RTV adapts by investing in unique digital content and being more selective in acquisitions and productions. Co-productions and flexible deals with distributors help us continue delivering high-quality content,” Utomo says.

Also in Indonesia, ANTV’s Tandiana highlights the financial squeeze facing free-to-air channels. “In the past 12 months, particularly in the free-to-air landscape, we’ve experienced a noticeable decline in advertising revenue. This trend has affected almost all FTA broadcasters in Indonesia. As a result, the key challenge has been acquiring high-quality content with more limited budgets. This has pushed us to be more selective in curating content, while also requiring greater flexibility in terms and rights negotiations with partners,” he says.

Some see opportunity in programming shifts. DM Don Square Entertainment’s Abdullah highlights the rise of family dramas, while Kou Serey Ratha of Bayon says balancing TV and online preferences is an ongoing challenge.

WHAT’S THE OUTLOOK? Cross-border collaboration and co-operation is a key theme that continues into the year ahead. Media Prima’s Foo stresses the importance of cross-border collaboration: “We’re hoping for more cross-region collaborative opportunities to strengthen the industry.” Similarly, ANTV’s Tandiana emphasises the need to deepen cooperation between rights owners and broadcasters.

Most buyers expect their acquisitions of non-Asian content to remain steady for the next 12 months. Two-thirds (66.7%) say they will acquire about the same amount in 2025 and 2026 as in previous years, while 14% expect to increase non-Asian acquisitions.

Another 14% anticipate acquiring less non-Asian content, citing stronger emphasis on regional programming and local audience demand. As one buyer says: “We’re only choosing non-Asian titles with fresh stories and strong differentiation from local offerings”.