Global streamers have slashed Korean commissions by 43% and local production – crippled by rising production costs – fell by 20% in the two years between the first half of 2023 and the first half of 2025, a new report from Ampere Analysis shows.

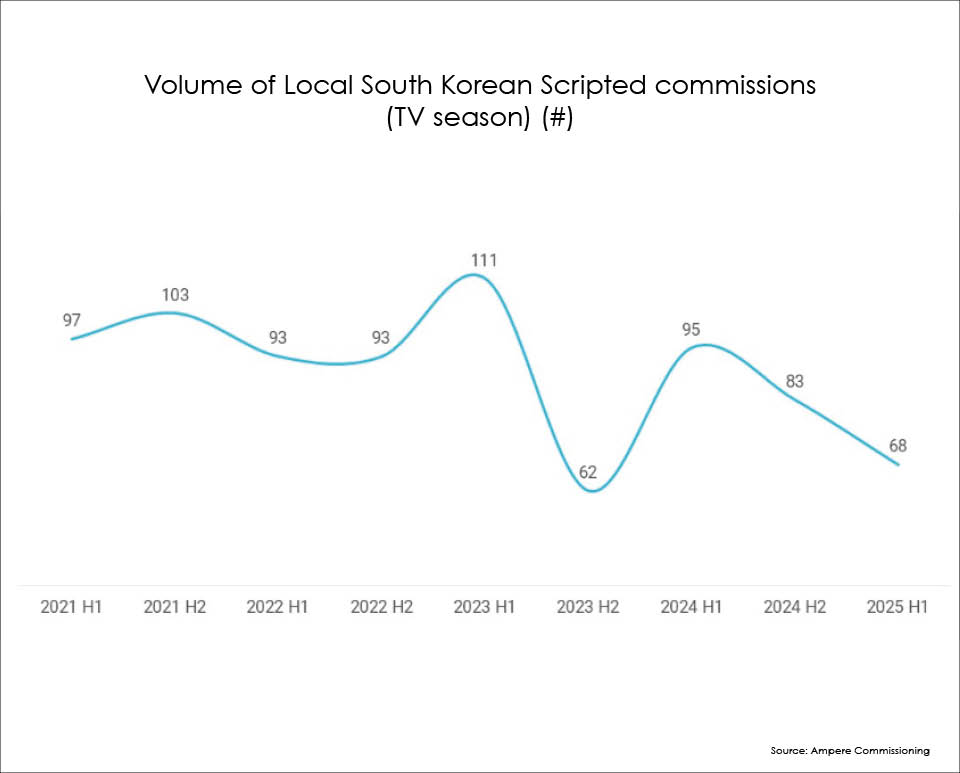

Scripted commissions have been hit hardest; the number of scripted announcements dropped 39% between the first half of 2023 and the first half of 2025.

Netflix has bucked the trend, maintaining volume while would-be global rivals cut Korean commissions. Ampere says Netflix accounts for 88% of South Korea’s H1 2025 global SVoD announcements, but has reduced its proportion of scripted content as it shifts its focus to unscripted.

The August 2025 report said global demand was expanding even as commissions were shrinking.

“Local companies have struggled with rising production costs and the broader macroeconomic challenges, while international SVoD [platforms] are shifting their content strategy towards acquisitions and original unscripted K-content,” Ampere says.

The share of viewers outside Korea who say they watch South Korean TV series or films “sometimes” or “very often” rose from 22% in Q1 2020 to 35% in Q1 2025 – a 13 percentage point increase.

Ampere said the availability of South Korean content on international streaming services increased by 55% between 2021 and 2024.

Ampere Analysis analyst, Mariana Enriquez Denton Bustinza, said moves like Netflix’s cap on actors’ fees could lead to a “more accessible and reinvigorated local production landscape” – and particularly the proportion of content being produced for local platforms and channels.

“As large international players moved into the Korean market, they found success with Korean content among a worldwide audience, which has seen them invest heavily in original Korean content,” says Fred Black, Ampere’s research director.

“This has pumped investment into the Korean production landscape and electrified the demand for Korean content globally. But it has also caused significant inflation to production costs in Korea. This has then had the effect of prici...

Global streamers have slashed Korean commissions by 43% and local production – crippled by rising production costs – fell by 20% in the two years between the first half of 2023 and the first half of 2025, a new report from Ampere Analysis shows.

Scripted commissions have been hit hardest; the number of scripted announcements dropped 39% between the first half of 2023 and the first half of 2025.

Netflix has bucked the trend, maintaining volume while would-be global rivals cut Korean commissions. Ampere says Netflix accounts for 88% of South Korea’s H1 2025 global SVoD announcements, but has reduced its proportion of scripted content as it shifts its focus to unscripted.

The August 2025 report said global demand was expanding even as commissions were shrinking.

“Local companies have struggled with rising production costs and the broader macroeconomic challenges, while international SVoD [platforms] are shifting their content strategy towards acquisitions and original unscripted K-content,” Ampere says.

The share of viewers outside Korea who say they watch South Korean TV series or films “sometimes” or “very often” rose from 22% in Q1 2020 to 35% in Q1 2025 – a 13 percentage point increase.

Ampere said the availability of South Korean content on international streaming services increased by 55% between 2021 and 2024.

Ampere Analysis analyst, Mariana Enriquez Denton Bustinza, said moves like Netflix’s cap on actors’ fees could lead to a “more accessible and reinvigorated local production landscape” – and particularly the proportion of content being produced for local platforms and channels.

“As large international players moved into the Korean market, they found success with Korean content among a worldwide audience, which has seen them invest heavily in original Korean content,” says Fred Black, Ampere’s research director.

“This has pumped investment into the Korean production landscape and electrified the demand for Korean content globally. But it has also caused significant inflation to production costs in Korea. This has then had the effect of pricing out local platforms and channels from being able to produce the same quantities of their own local content, as production capacity is taken up by more expensive projects for international players,” Black says.

Now, global streaming services are beginning to revise down their commitment to original content in Korea – a function of cost-cutting initiatives.

“However, there is ongoing demand for that content from a large global audience. This should encourage local platforms and channels to commission more, and take risks on more expensive content, with the certainty there is an international audience out there for it.”

If there are fewer originals than before, global players may well drive an invigorated syndication/distribution market.

▶ Published in ContentAsia September 2025 Magazine