[By Patrick Frater] Asian film and TV executives at the ATF were presented with a range of production finance techniques on Tuesday that offer to make investing safer, budgets stretch further and attract outside investors. Most of the methods are employed in the U.S. and Europe, but are not so commonly used in Asia.

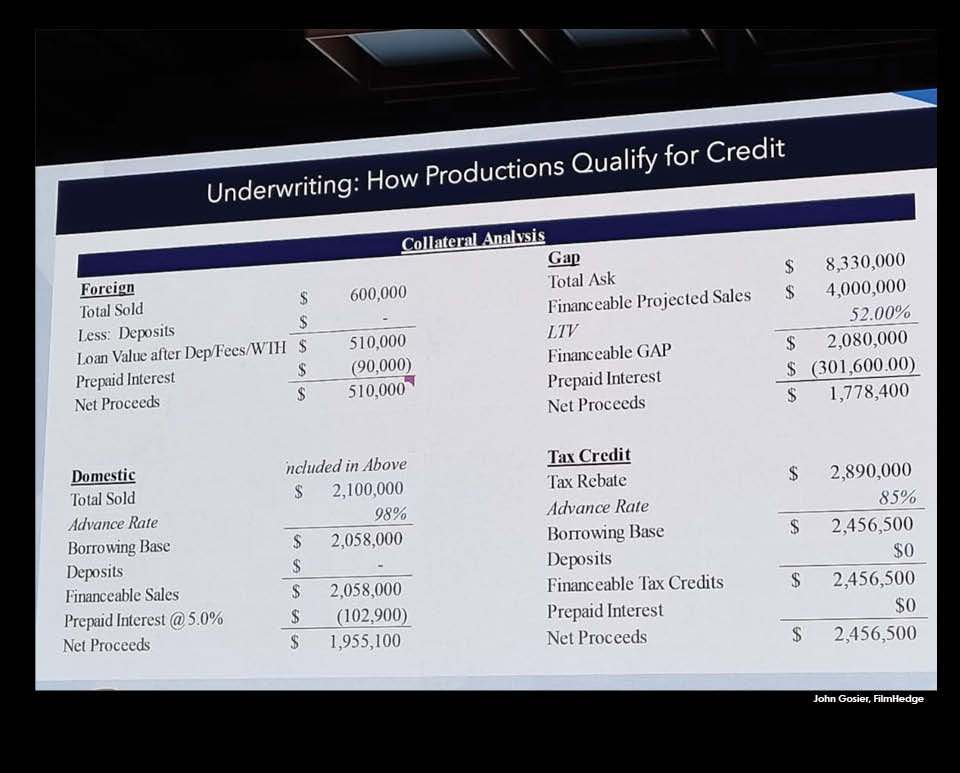

John Gosier of U.S.-based FilmHedge described the current film industry landscape as one in which pre-sales are diminishing, studios are growing conservative and distribution systems are being both opened up and fragmented by technology.

The responses to this scenario, he argued, include a rise in private credit (from sources including family offices and sovereign wealth funds) and a greater need for risk mitigation and transparency.

He told delegates gathered at the ATF Leaders Dialogues event that they should stop using so much equity and increase the proportion of debt. This, he said, could unlock a film’s potential collateral that comes from pre-sales, tax credits and the attachment of a local

distributor.

He added that Asian producers had not fully woken up to the overseas attractiveness of the films they were producing.

FilmHedge makes use of a proprietary database on film underwriting and typically lends against collateral such as state incentives.

Challenging established perceptions of risk, Gosier said: “We want to prove that film and TV is the best place to place your money – the least risky, most undercapitalised and represents the most opportunity out there.”

At a related panel discussion, East West Bank’s Bennett Pozil represented the banking sector, Steve Berman of Film Finances represented the completion bond industry and Phil McKenna of the UK’s Goldfinch described his role as the manager of a fund that is close to making its first disbursements in Indonesia.

Completion bonds, which provide a guarantee to investors that a film project will be completed according to a pre-set schedule, but which may mean that the bond company take...

[By Patrick Frater] Asian film and TV executives at the ATF were presented with a range of production finance techniques on Tuesday that offer to make investing safer, budgets stretch further and attract outside investors. Most of the methods are employed in the U.S. and Europe, but are not so commonly used in Asia.

John Gosier of U.S.-based FilmHedge described the current film industry landscape as one in which pre-sales are diminishing, studios are growing conservative and distribution systems are being both opened up and fragmented by technology.

The responses to this scenario, he argued, include a rise in private credit (from sources including family offices and sovereign wealth funds) and a greater need for risk mitigation and transparency.

He told delegates gathered at the ATF Leaders Dialogues event that they should stop using so much equity and increase the proportion of debt. This, he said, could unlock a film’s potential collateral that comes from pre-sales, tax credits and the attachment of a local

distributor.

He added that Asian producers had not fully woken up to the overseas attractiveness of the films they were producing.

FilmHedge makes use of a proprietary database on film underwriting and typically lends against collateral such as state incentives.

Challenging established perceptions of risk, Gosier said: “We want to prove that film and TV is the best place to place your money – the least risky, most undercapitalised and represents the most opportunity out there.”

At a related panel discussion, East West Bank’s Bennett Pozil represented the banking sector, Steve Berman of Film Finances represented the completion bond industry and Phil McKenna of the UK’s Goldfinch described his role as the manager of a fund that is close to making its first disbursements in Indonesia.

Completion bonds, which provide a guarantee to investors that a film project will be completed according to a pre-set schedule, but which may mean that the bond company takes control of production and replaces a director, are rarely used in Asia. Reasons for this include budget scale, paucity of professional investors, less than comprehensive contracts, alternative finance

systems and cultural reluctance.

Bing Chen of Gold House described his organisation as both making use of underused cultural assets and trying to make connections across different content types. Gold House also has a non-profit arm which he described as “patient mission-oriented capital”.

Pozil said many Asian films struggled to assemble enough collateral to use either the banking system or the bonding model. “This is where it would be great for ASEAN governments to come together to make independent films a priority’, he said.

“Current risk appetite and sources [in Asia] are mostly about equity. We need to convince investors that they can lower that, use less [equity] and make their money go further,” said McKenna.

He explained that Goldfinch is comfortable working without completion bonds and is now seeking to reduce the amounts of documentation necessary for investment agreements, thus making professional finance more acceptable to Asian players.

But the panel took a worrying – or more realistic – turn when several speakers said that entertainment investment is a mug’s game.

“[Investors need to] recalibrate and not expect hard returns from investment in culture and the creative sector,” said Chen. “We are constantly compared against real estate. And failing.”

“Why do people get into the film business as filmmakers, as creators as investors. It is not to make money. It is to make an impact”, said Pozil.

The session also heard speakers discuss the increasing shift of private capital to focus on lifestyle and quality of life, where return on investment (ROI) is replaced with "return on experience or return on interest”.