Creators can hold their noses until they die at cheesy scripts and over-the-top drama... but microdramas aren’t going anywhere but centre stage. What started as shock-and-awe growth that dazzled boardrooms is now a full-blown debate across the industry about how to weave bite-sized, vertical storytelling into the mainstream production and entertainment business.

The next wave of microdramas could see production budgets escalate to US$600,000 per series, driven primarily by Chinese platforms accelerating investment into premium content.

Right now though, producers in the rest of Asia look, laugh and settle for full-series (60-80 mins) budgets in the US$50,000 to US$75,000 range. In some markets, this tops out at US$150,000, with most current titles made for between US$75,000 and US$100,000.

There’s also a thriving market for finished scripts, which sell for around US$10,000 each.

In the U.S., series production budgets range from US$150,000 to US$200,000 (max US$300,000) for 80-minutes. U.S.-based analysts, Owl & Co, caps current production budgets at US$250,000.

Although not as vibrant as China or the U.S., U.K. producers are venturing into the vertical space, being paid between £1,500/£2,000 to £3,000/4,000 per episode for a 60-episode series. Brands are boosting activity, paying between £20,000/US$27,000 and £30,000/£40,000 for 20 to 30 episodes of a one-off series built around their product.

“Money in microdrama is already a subject of heated debate,” says U.K.-based director and format creator, Jonathan Glazier, who just published a three-part deep dive into microdrama as part of his alt.media Substack platform. Glazier is currently developing shows for broadcasters and platforms in the Philippines, Bhutan, India and Singapore, following three recent commissions in the region.

“There is no single route to [microdrama] funding,” Glazier tells fellow producers, listing a seven-point directory of choices. These include self-, brand-, and platform-funded as well as dedicated platform commissions, which he calls “the old television model in new clothes”, where platforms fund production, pay a producer’s fee and take ownership of everything.

Glazier outlines fo...

Creators can hold their noses until they die at cheesy scripts and over-the-top drama... but microdramas aren’t going anywhere but centre stage. What started as shock-and-awe growth that dazzled boardrooms is now a full-blown debate across the industry about how to weave bite-sized, vertical storytelling into the mainstream production and entertainment business.

The next wave of microdramas could see production budgets escalate to US$600,000 per series, driven primarily by Chinese platforms accelerating investment into premium content.

Right now though, producers in the rest of Asia look, laugh and settle for full-series (60-80 mins) budgets in the US$50,000 to US$75,000 range. In some markets, this tops out at US$150,000, with most current titles made for between US$75,000 and US$100,000.

There’s also a thriving market for finished scripts, which sell for around US$10,000 each.

In the U.S., series production budgets range from US$150,000 to US$200,000 (max US$300,000) for 80-minutes. U.S.-based analysts, Owl & Co, caps current production budgets at US$250,000.

Although not as vibrant as China or the U.S., U.K. producers are venturing into the vertical space, being paid between £1,500/£2,000 to £3,000/4,000 per episode for a 60-episode series. Brands are boosting activity, paying between £20,000/US$27,000 and £30,000/£40,000 for 20 to 30 episodes of a one-off series built around their product.

“Money in microdrama is already a subject of heated debate,” says U.K.-based director and format creator, Jonathan Glazier, who just published a three-part deep dive into microdrama as part of his alt.media Substack platform. Glazier is currently developing shows for broadcasters and platforms in the Philippines, Bhutan, India and Singapore, following three recent commissions in the region.

“There is no single route to [microdrama] funding,” Glazier tells fellow producers, listing a seven-point directory of choices. These include self-, brand-, and platform-funded as well as dedicated platform commissions, which he calls “the old television model in new clothes”, where platforms fund production, pay a producer’s fee and take ownership of everything.

Glazier outlines four levels of series budgets, beginning with nano of between £500/US$670 and £2,000/US$2,700, shot on phones with friends, and rising to platform funded budgets of £300,000+/US$400,000+. He also reports top-end productions at US$600,000 per title.

In between come indie budgets of between £5,000/US$6,700 and £20,000/US$27,000. These involve a small professional team, hired kit, locations and licensed music (In other words, “enough to look polished,” Glazier says).

Studio budgets of above £50,000/US$67,000 are also in the mix. These involve a full production crew, set builds and professional actors, and are often linked to brand or broadcaster support.

A sample production budget of around US$220,000 includes US$7,000 for a head writer, including script and revisions, and US$5,000 for assistant writers and a script editor. The largest total cost is US$36,000 for actors; this involves six lead actors at US$500 a day for 12 days. Glazier adds US$6,000 for supporting/day players, bringing the on-screen talent costs to a total of US$42,000. The budget for a director is US$12,000 for 12 days, and the DoP is US$9,000. The post-production costs include two editors at US$9,000 each for three weeks’ work.

Glazier urges producers not to think of microdrama as a new genre. “Think of it as a new grammar” that matches “the rhythm of the scroll,” he says, adding that this is a “sector that is in need of disruption, and consumers need to be served and not exploited”.

“My opinion is simple,” Glazier says. “If the sector is to thrive it needs to step back from short-term profiteering. Viewers will eventually notice how much they are spending. If cancelling an account is difficult and they feel manipulated, trust will erode. Once trust is gone, the entire sector could take on the taint of mistrust. It is much harder to rebuild than to get it right the first time.”

In an adjacent Substack, Straight Up, where he reviews new titles and their platforms, Glazier points to The Diamond Rose as a series that “shows both the promise of microdrama and the risk: if platforms cling to gatekeeping, they’ll end up looking more like the broadcasters they were meant to replace”.

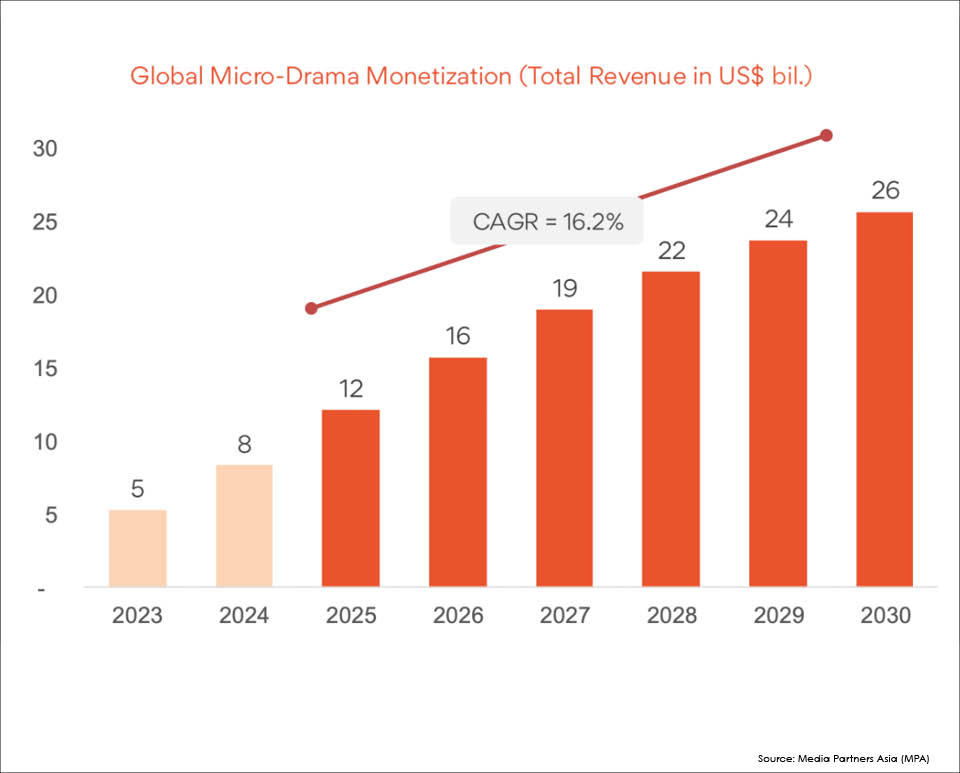

If producers continue to poke into every nook and cranny of the short-form vertical video environment to see if this is where they really truly want to be, boardrooms remain unequivocally dizzy over financial projections.

In its microdrama report released in September, Media Partners Asia (MPA) predicted China’s 2025 revenues to exceed US$9.4 billion, overtaking domestic box office. More than 830 million viewers across the mainland now consume microdramas, of which nearly 60% pay or transact, says “The Microdrama Economy” report.

China revenues climbed from US$0.5 billion in 2021 to US$7 billion in 2024 and are expected to exceed US$16.2 billion by 2030 (11.5% CAGR). By 2030, advertising will contribute 56% of revenues, with subscriptions at 39% and commerce at 5%, MPA says.

In Asia, Japan leads with revenues forecast to top US$1.2 billion by 2030. The rest of Asia remains cost-conscious; still operating at lower budgets, despite growing audience interest.

Outside of China, the global microdrama market is forecast to reach US$9.5 billion by 2030 (28.4% CAGR) from 2024’s US$1.4 billion. The revenue mix will remain subscription/IAP-led (74%), but advertising will rise to 25% and commerce to 1% by 2030.

Global markets are led by the U.S., where revenues reached US$819 million in 2024, and are projected to rise to US$3.8 billion by 2030, MPA says. Audience adoption is driven by affluent, urban women aged 30-60.

The fact that short drama apps are on track to hit US$3 billion (excl. China) this year is an important milestone, says Owl & Co founder and former Fox International Channels’ boss, Hernan Lopez.

In a LinkedIn post in September, Lopez said while short drama apps’ revenue was small right now compared to Netflix or YouTube, this year’s US$3 billion (excl. China) “marks something we’ve never had before: a functioning market for short-form scripted storytelling”.

“Now the glass is no longer empty,” Lopez continues. “If you’re quick to dismiss the short dramas of today as too soapy, too gamified, or not for you, you risk missing three larger forces at play: Time spent with mobile video, where vertical is the default, keeps rising. Production cutbacks mean more storytellers are embracing new formats. SVODs are fighting not just each other but YouTube, TikTok, Instagram for time spent and ad dollars. They’re not going to sit idle while a whole new way of storytelling takes off.”